3 strategies to help consumer brands survive the cost-of-living crisis - webinar overview

Market Insights

This article is about our webinar The dreaded cost-of-living crisis: 3 strategies for consumer brand survival. Read on for a summary of the session or click here to watch the recording.

The cost of living has been rising since the beginning of 2022, and the situation is now becoming unbearable for many consumers. What kind of price increases will be appropriate this winter? Are there other strategies consumer brands could use to keep their businesses profitable?

In this webinar, Johanna Kuosmanen, Digital and Customer Experience Director at Finland’s largest pizza chain, Kotipizza, shares which strategies the company has adopted to survive a highly price-sensitive market, even when consumers are cutting back on their spending.

This session is a follow-up to a previous webinar Cambri hosted in spring 2022: Fight inflation without losing customers: A study about consumers’ reactions to price increases. Dr Outi Somervuori, Founder and Head of Research at Cambri, shows how consumer attitudes and coping mechanisms for inflation have changed since March 2022 and what this means for consumer brands.

You’ll learn:

- What consumers do to manage smaller grocery budgets

- What currently drives consumer grocery budgets

- 3 strategies consumer brands can use to survive a cost-of-living crisis

00:03:07 Meet Kotipizza, the business case for this webinar

Kotipizza is the largest pizza chain in Finland, established in 1987, with 300 restaurants and 280 independent franchises. It’s known in Finland as an agile market leader that adapts to changes in the world. Their decision-making is driven by data, and they’re active users of market research and Cambri’s platform.

00:07:30 What's changed in consumer behaviour since March 2022?

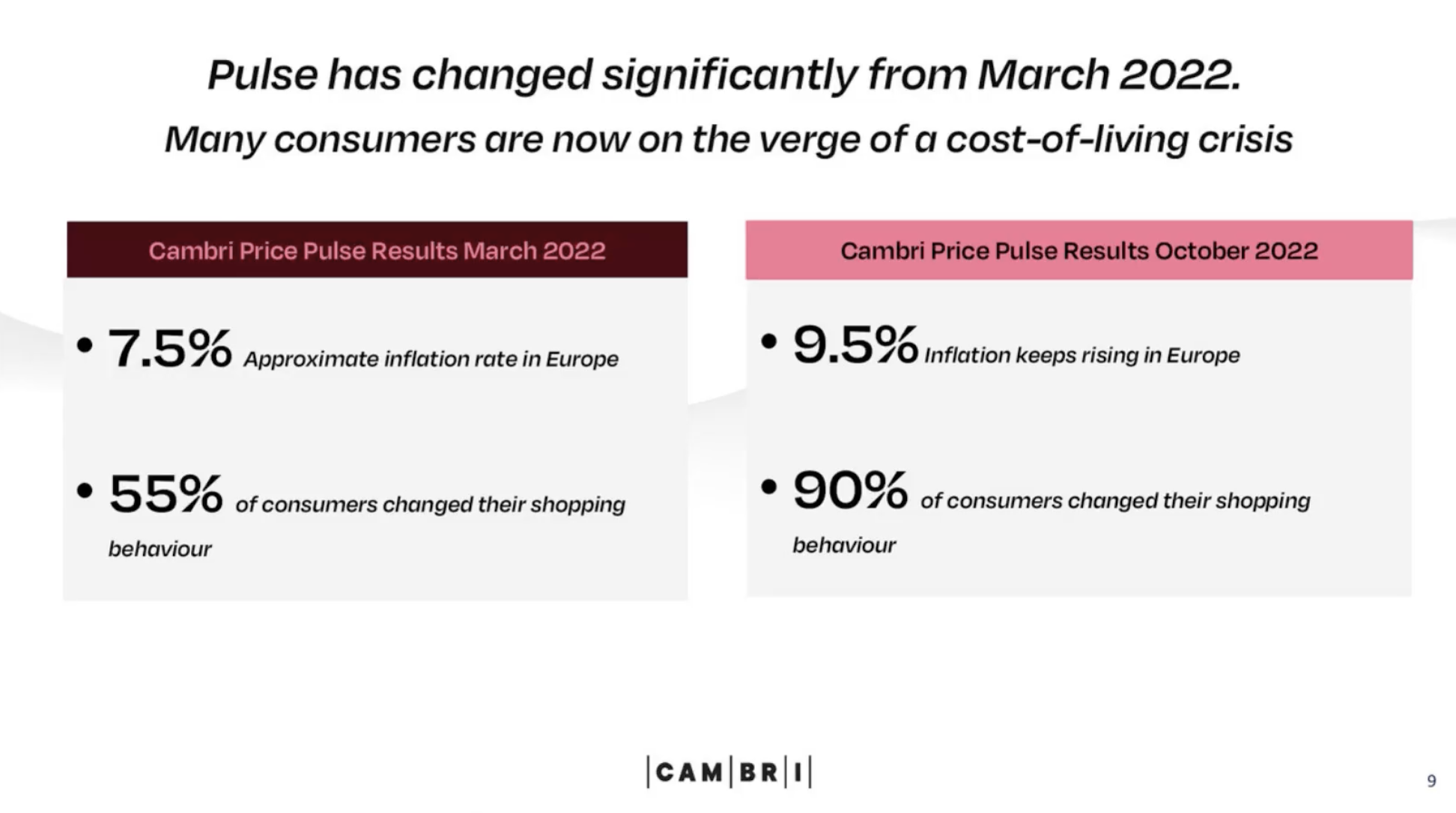

Outi Somervuori introduces Cambri’s Price Pulse research conducted across European countries in March and October 2022. In spring, the inflation rate in Europe was 7.5%. By October, it had risen to 9.5%. Six months ago, consumers still considered price increases to be acceptable and the motivations for them to be reasonable. Now, the situation has changed. Many consumers are on the verge of a cost-of-living crisis, and further price increases may force consumers to stop purchasing. Research shows that 90% of consumers have changed their shopping behaviour because of inflation.

In spring, brands could increase their prices to a certain point without losing customers. October data suggests companies should manage prices carefully as price increases could carry the risk of losing customers.

00:11:15 What do consumers do to manage smaller grocery budgets?

Somervuori explains that there are 3 types of behaviour we can see in a cost-of-living crisis:

- Consumers buy in bulk

- Consumers buy cheaper products

- Consumers stop buying

Every consumer chooses their own strategy to manage their grocery budget. Even though media attention is mainly on how consumers cut down on consumption, this is not true for all consumers. That’s why companies should dig deeper into their buyer segments.

00:13:04 Think: What motivates your purchases?

If you were choosing an electricity provider now, would you choose the cheapest provider, an environmentally friendly provider or a company you know?

If you were buying beef, would you choose the cheapest beef, locally produced beef or a brand you know?

Watch the webinar to see how participants replied to these questions and what that reveals about the different purchasing behaviours people are adopting at this time.

00:15:47 Purchase behaviour is driven by motivation and motivation varies by category and situation

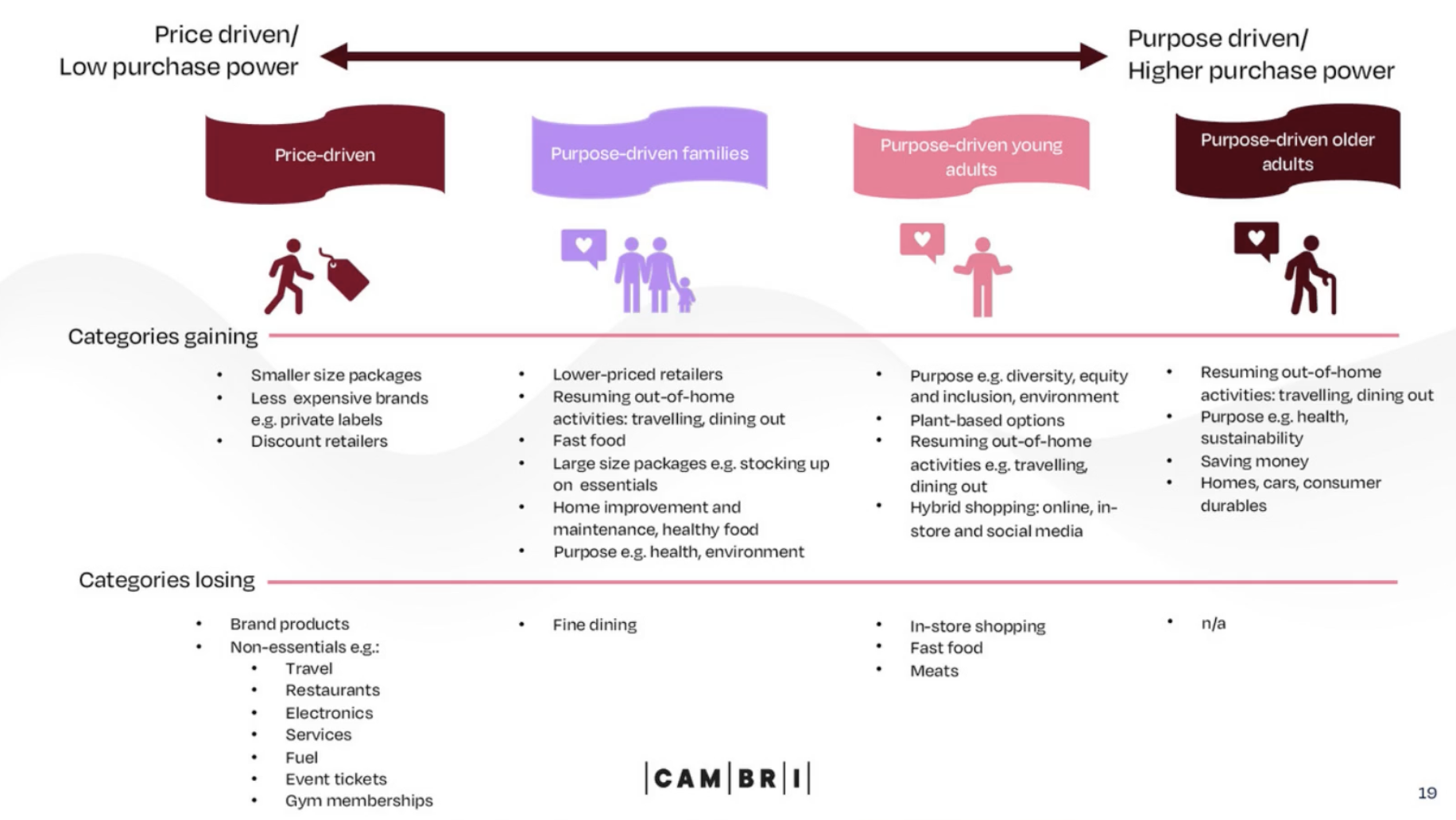

Even though price is the most significant motivator for purchase behaviour, 34% of European consumers and 44% of US consumers are motivated by a company’s purpose statements. These purpose statements can range from fair treatment of employees to sustainability, diversity and inclusivity. Cambri’s research shows that price-driven and purpose-driven consumers respond differently to price changes.

There are also other factors that determine what people decide to consume or stop consuming, such as purchase power and age. The image below shows how different consumer segments behave during a cost-of-living crisis.

00:22:10 What are the 3 strategies consumer brands can use to survive the cost-of-living crisis?

- Sell cheaper, smartly

- Take a stand and focus on your purpose

- Be innovative on all sales channels

00:25:00 Strategy 1: How Kotipizza uses promotions and campaigns to target a disloyal customer segment

Johanna Kuosmanen introduces the five motive-based segments Kotipizza has identified and followed for the past five years. The company uses these segments when planning products, marketing and campaigns.

“At the moment, we see people are not responding similarly,” she says. “We have a big segment that is sensitive to price and size, but they are not the customers who visit Kotipizza restaurants regularly. They are the ones looking for campaigns and discounts. Because this segment is very large, it is important to serve them even though they only visit us now and then.” Kotipizza targets this price-sensitive segment through coupon discounts and price campaigns.

Though the price-sensitive segment is important, it represents only one of Kotipizza’s customer segments. One of the most interesting segments is purpose-driven customers. They choose Kotipizza because it’s easy to use, acts responsibly and has a good reputation. This segment is constantly growing, and their purchasing power is high. They are worth investing in because they’re willing to pay more if they feel they get high value for their money.

One of the products Kotipizza developed to target this group is a pizza called Sienimestari, which includes locally-grown mushrooms. The pizza has become one of the most popular on the menu, even though it’s also the most expensive.

The combination of price campaigns and tailored, purpose-driven products serves Kotipizza’s most important customer segments well and has resulted in more overall sales.

00:29:28 How to find out how consumers respond to different products, packaging sizes and prices

Somervuori explains how companies can use conjoint analysis to test different products and packaging sizes to find out how consumers will respond to changes in product selection. She introduces a case study comparing different tea brands and packaging sizes. The test showed how the change in packaging size would affect sales.

00:34:34 Strategy two: How Kotipizza changed their brand to attract purpose-driven consumers

Seven years ago, Kotipizza completely reinvented its brand to survive in an industry propelled by price-driven competition. “Sustainability and responsibility became the core values of our new brand. This meant we renewed all of our packaging and focused on providing more domestic ingredients in our pizzas. Now, 70% of our ingredients are domestic produce,” Kuosmanen explains.

The renewed brand had a positive impact on Kotipizza’s sales. “Our image as a responsible brand grew from 42% to 54%. Eco-friendliness has become one of the key drivers for visiting Kotipizza.”

00:40:00 How to know if people are willing to pay for sustainability

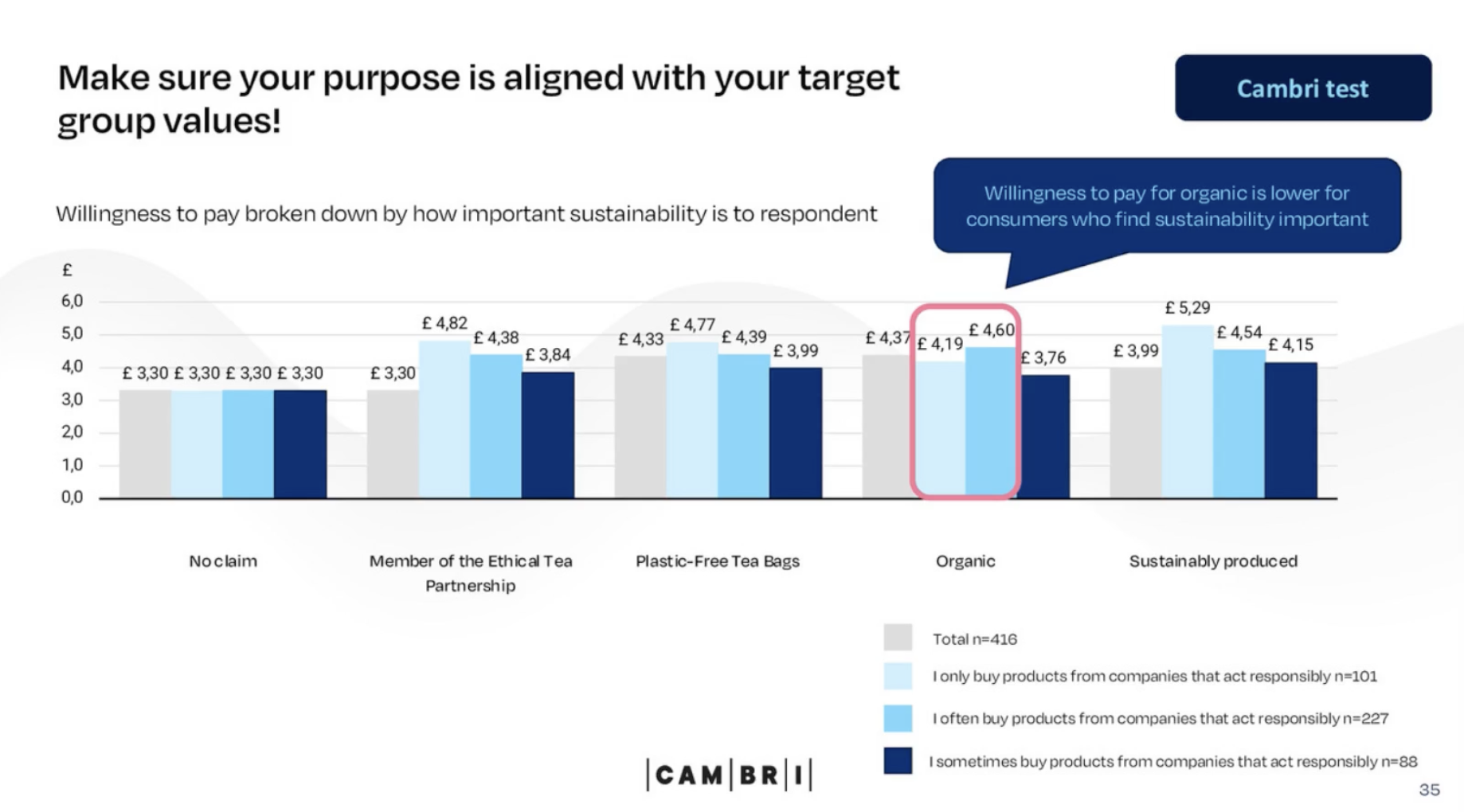

Somervuori presents a case example where conjoint analysis was used to test how different responsibility claims influenced purchase behaviour. The results show some responsibility claims are more powerful than others and generic claims work better than specific ones.

The test also showed how willing consumers are to pay for a product without responsibility claims in comparison to products with responsibility claims. It's not surprising that the best claims increase willingness to pay a higher price for the product.

Generic claims work better than specific ones.

However, there are also different niches within the responsibility segment. Consumers who say they usually buy from responsible brands are more willing to pay for products with responsibility claims. However, the consumers who value ecological claims are not necessarily the same ones who value organic produce claims. So, it is important to understand how your purpose is aligned with your target group’s values on a very detailed level.

00:45:44 Strategy three: How Kotipizza made dynamic delivery one of their most important service features

The world and consumer behaviour are continuously evolving, so the most innovative brands keep up with the latest digital channels and create their own strategy for them. Kotipizza has chosen to own all its channels, including delivery. Instead of using popular delivery platforms, the company created their own delivery system with dynamic delivery pricing. The prices change according to demand – a pricing model familiar to consumers from the travel industry. Since changing their delivery strategy from static pricing to dynamic pricing, the company has seen an increase in deliveries and has even increased the number of weekday orders.

00:49:00 Learn more: Q&A

The webinar finished with a questions and answers session with both speakers.

Want to hear more? Watch the full webinar.

We encourage you to take a look and see what other topics we've covered in our on-demand sessions!